Biweekly tax withholding calculator

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. The W-4 requires information to be entered by the wage earner in order to tell their employer how.

395 11 Federal State Withholding Taxes

Occupational Disability and Occupational Death Benefits are non-taxable.

. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check.

For employees withholding is the amount of federal income tax withheld from your paycheck. Accordingly the withholding tax due computed by the calculator cannot be used as basis of complaints of employees against their employers. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

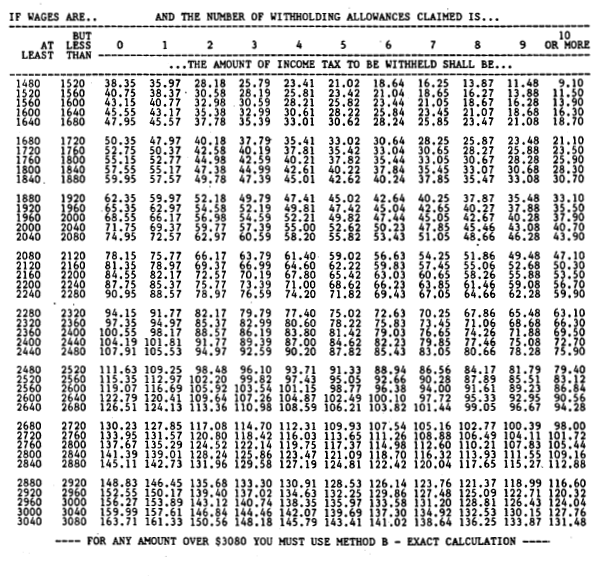

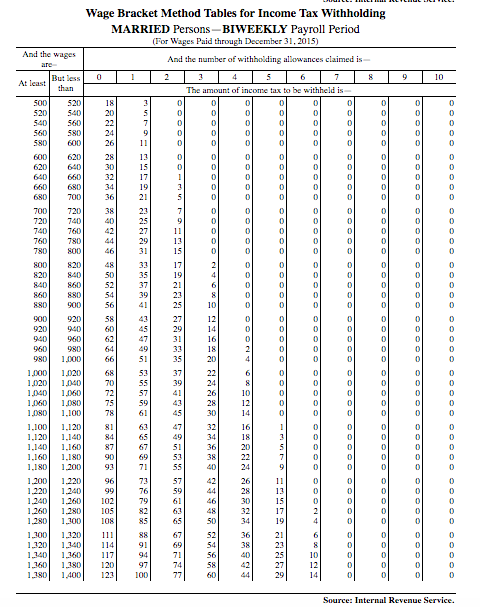

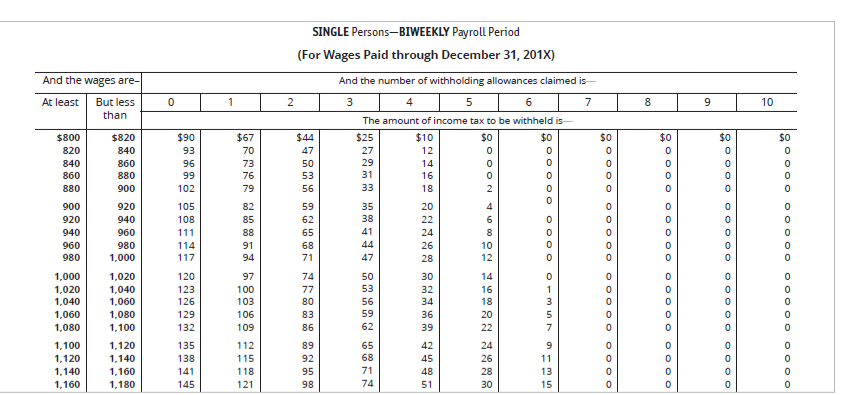

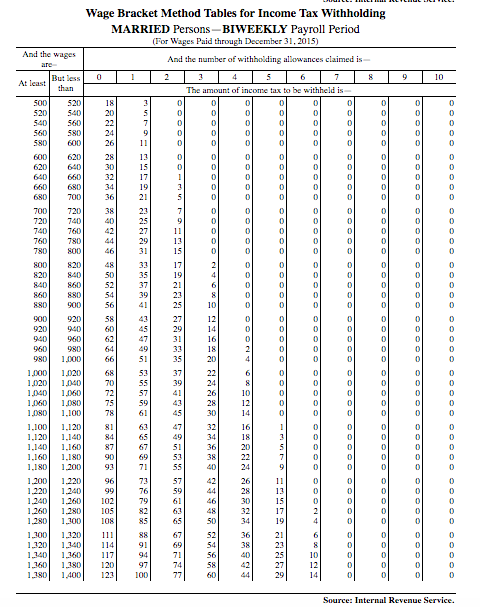

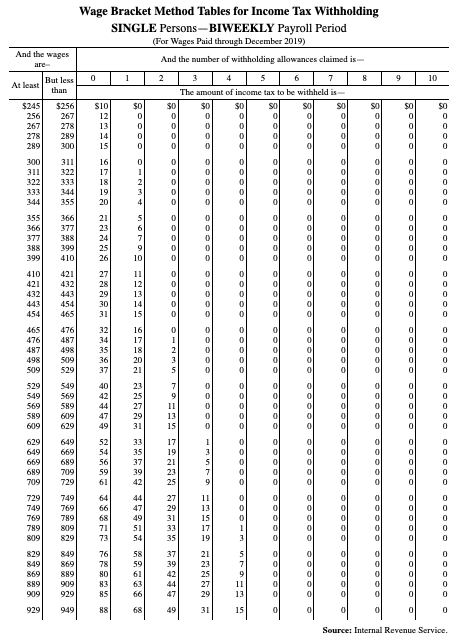

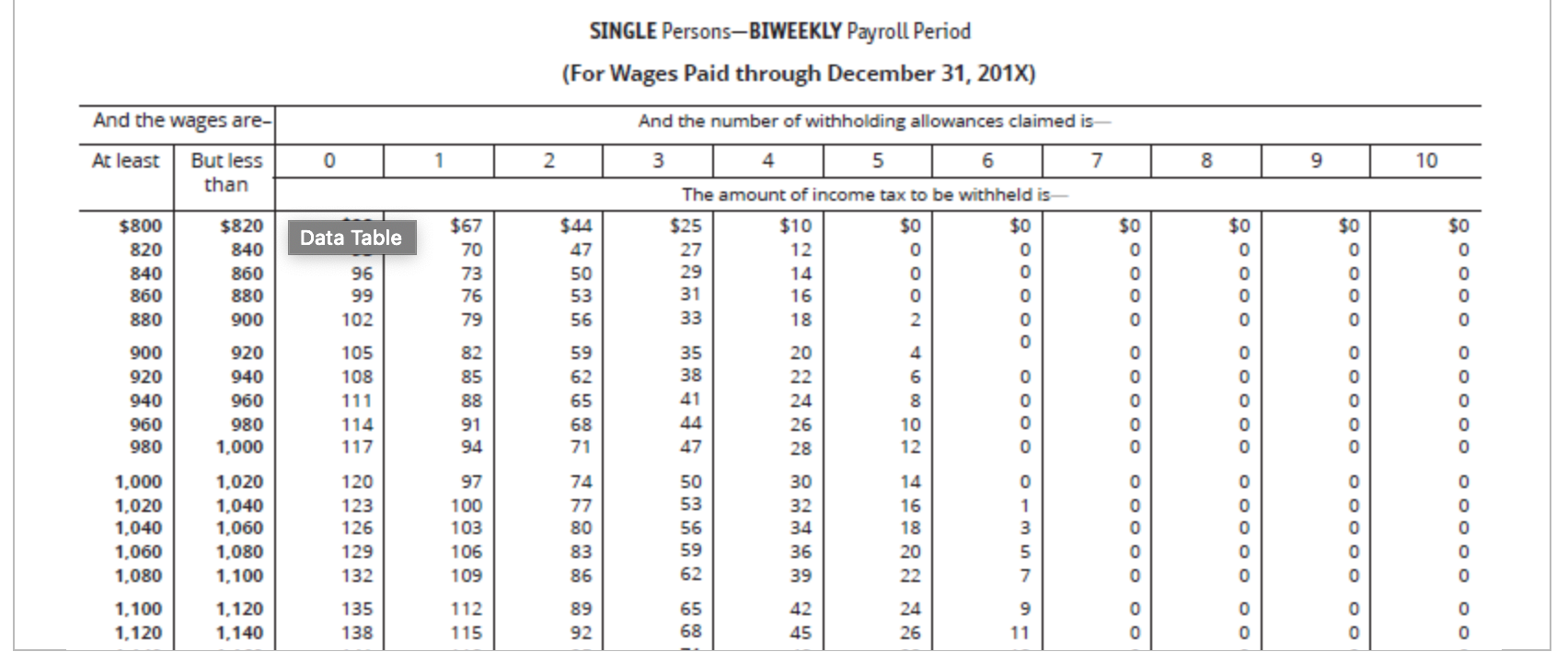

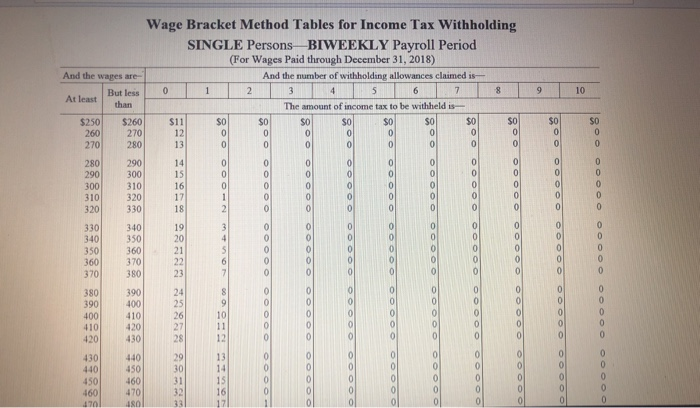

You can use your results from the calculator to help you complete the. The amount of income tax your employer withholds from your regular pay depends on two things. It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming.

This marginal tax rate means that your immediate additional income will be taxed at this rate. 15 Employers Tax Guide and Pub. Your average tax rate is 270 and your marginal tax rate is 353.

Ad Payroll So Easy You Can Set It Up Run It Yourself. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

250 minus 200 50. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. This marginal tax rate means that your immediate additional income will be taxed at this rate.

The Withholding Calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Ad Learn More about How Annuities Work from Fidelity. Biweekly pay 52 weeks.

Be sure to have information regarding your income dependents and any additional items worth valuable deductions and credits including education expenses and itemized. If you are withholding tax from a nonresident employee who works in. This is a projection based on information you provide.

Then look at your last paychecks tax withholding amount eg. If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances claimed.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. For 2010 the value of each biweekly allowance equals 14038 so if you claimed three allowances you would multiply 14038 by 3 to get 42114. Submit or give Form W-4 to your employer.

Based on the number of withholding allowances claimed on your W-4 Form and the amount of wages calculate the amount of taxes to withhold. That result is the tax withholding amount you should aim for when you use this tool in this example 50. Get Started Today with 2 Months Free.

If you are withholding tax from a nonresident employee who works in. Your average tax rate is 220 and your marginal tax rate is 353. Our online Weekly tax calculator will automatically.

The Withholding Calculator helps you determine whether you need to give your employer a new Form A-4 Arizona Withholding Percentage Election. And others are paid bi-weekly 26 paychecks per year. This publication supplements Pub.

Then make adjustments to your employer W-4 form if necessary to more closely match your 2022 federal tax liability. Ad Run your business. 2022 Federal Tax Withholding Calculator.

This marginal tax rate means that your immediate additional income will be taxed at this rate. All Services Backed by Tax Guarantee. Number of Exemptions from MW507 Form.

Thats where our paycheck calculator comes in. 250 and subtract the refund adjust amount from that. 51 Agricultural Employers Tax Guide.

Biweekly pay 48 weeks. That means that your net pay will be 43041 per year or 3587 per month. Well run your payroll for up to 40 less.

No validation process is being performed on the. To change your tax withholding amount. The frequency of your paychecks will affect their size.

Big on service small on fees. More details about the Tax Withholding Estimator and the new 2020. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

If you participate in tax deferred retirement pre-tax benefits health insurance premium or dependent care spending deductions subtract those amounts from gross pay then. Use the tax withholding tables for your filing status found in the most recent version of IRS publication 15 to calculate your federal income tax withholding. That means that your net pay will be 37957 per year or 3163 per month.

Get Your Quote Today with SurePayroll. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Your average tax rate is 217 and your marginal tax rate is 360.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. To keep your same tax withholding amount. Ask your employer if they use an automated system to submit Form W-4.

Online Withholding Calculator For Tax Year 2022. Biweekly pay 50 weeks. Get your payroll done right every time.

The more paychecks you get each year the smaller each. That means that your net pay will be 40568 per year or 3381 per month. You dont need to do anything at this time.

Computes federal and state tax withholding for paychecks Flexible hourly monthly or annual pay rates bonus or other earning items. If you are married but would like to withhold at the. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

The withholding calculator can help you figure the right amount of withholdings.

Solved Compute The Net Pay For Each Employee Using The Chegg Com

How To Calculate Payroll Taxes Methods Examples More

Solved Wage Bracket Method Tables For Income Tax Withholding Chegg Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Calculating Federal Income Tax Withholding Youtube

Solved Note Use The Tax Tables To Calculate The Answers To Chegg Com

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Income Tax

How To Calculate Federal Income Tax

Calculation Of Federal Employment Taxes Payroll Services

1 On December 5 201x Prepare A Payroll Register Chegg Com

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Paycheck Calculator Take Home Pay Calculator

Solved Calculate The Amount To Withhold From The Following Chegg Com

Learning Objectives Calculate Gross Pay Employee Payroll Tax Deductions For Federal Income Tax Withholding State Income Tax Withholding Fica Oasdi Ppt Download

Paycheck Calculator Take Home Pay Calculator

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc